- Agile planning

- Competitive (dis)Advantages

- Doctor Advocacy and Perception

5K

partner doctors

with deep

relationships

5K

partner doctors

with deep

relationships

250K

parameters &

preferences per

doctor

250K

parameters &

preferences per

doctor

80%+

doctors with

longitudinal

data/ trends

80%+

doctors with

longitudinal

data/ trends

95%+

accurate predictor

of Rx share over

3-6 months

95%+

accurate predictor

of Rx share over

3-6 months

10%+

Improvement in

doctor

advocacy via

targeted GTM

10%+

Improvement in

doctor

advocacy via

targeted GTM

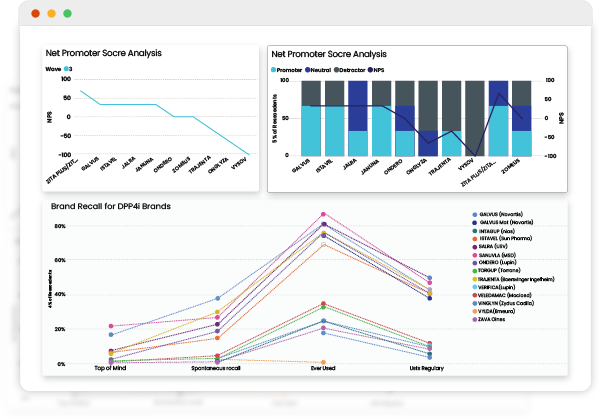

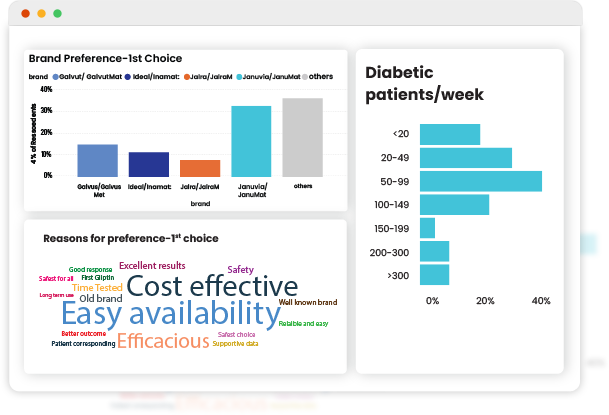

NPS based Customer

Advocacy

Most reliable leading indicator of doctor

stickiness and Rx share

Longitudinal Competitor benchmarking

Brand Positioning

and Messaging

Next Order Insight on Rx trends

Brand messaging to strengthen doctor

connect or to improve positioning

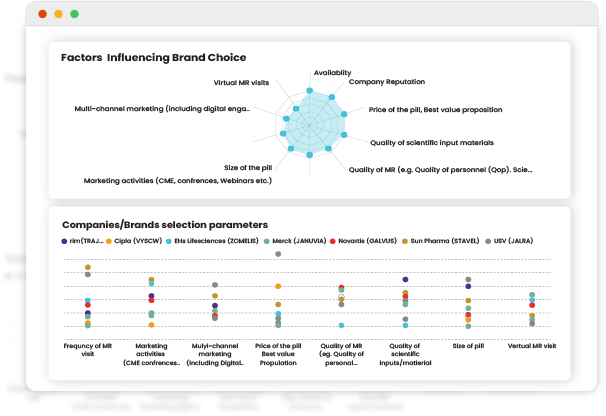

Multi-factor X-Ray

Deep understanding of relative comparison with competitors / peers across 8-10 factors

(Re)defining Marketing Activities to improvise

positioning across most important factors

- Learn from one of the most comprehensive oncology data banks across emerging markets

- Review rapidly evolving therapy trends with longitudinal patient journeys over 10+ years

- Identify macro & micro trends with detailed assessment of clinical outcomes

>100K

unique patient lives

with comprehensive

de-identified

datasets

>100K

unique patient lives

with comprehensive

de-identified

datasets

200+

parameters and

endpoints per

patient, including

genetic markers

200+

parameters and

endpoints per

patient, including

genetic markers

7

cancer types

included

7

cancer types

included

10+

years of longitudinal

data across

patients

10+

years of longitudinal

data across

patients

400+

oncologists covered

across partner

network

400+

oncologists covered

across partner

network

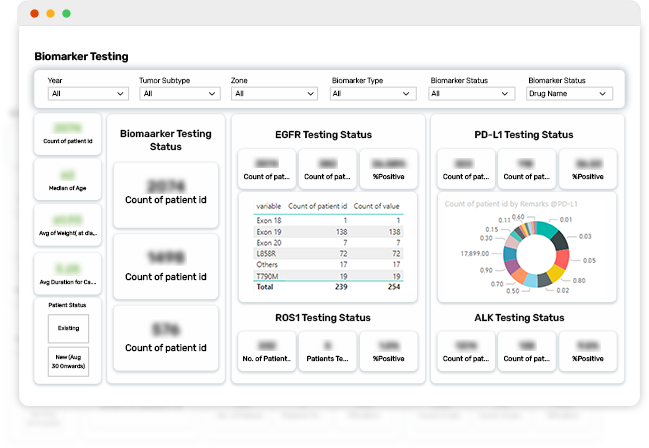

Tumor Profiling

Profiling and burden of cancer sub-types

Treatment choice across patient cohorts and cancer sub-types

Patient Profiling

Patient demographics and family history

Patient lifestyle and behaviours

Clinical and health conditions

Informed Cancer Care

Diagnostic methods across patient cohorts

Outcomes by diagnostic methods

Diagnostic methods to define treatment regimes and drugs

- Automated real-time monitoring of your hospital’s performance

- 200+ KPIs to track operational and clinical efficiency

- Improve your readiness for Audits and Accreditations

- Reduce operational costs and prevent revenue leakage

15-20%

reduction in

surgical

consumables

15-20%

reduction in

surgical

consumables

10%+

overall purchase

cost reduction

identified

10%+

overall purchase

cost reduction

identified

70%+

revenue upside

identified across

leakage points

70%+

revenue upside

identified across

leakage points

25%+

improvement in

working capital

25%+

improvement in

working capital

~10+

lower claim

rejections /

disallowances

~10+

lower claim

rejections /

disallowances

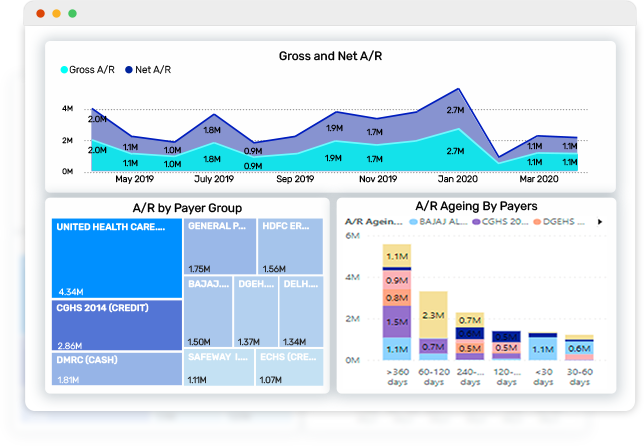

Measure and Monitor

Real time dashboards integrated across

360-degree data systems

End-to-end view across Strategic,

Financial, Clinical, Operational KPIs

Service Delivery and

Operations X-Ray

Key efficiency levers including, but not limited to, OP waittime, IP discharge time, lab reporting TAT, Triage time, OT utilization

Trigger enabled alerts on extreme operational shortfalls to ensure real-time interventions

Patient satisfaction correlations with operational efficiencies

Revenue Cycle

Management

Detailed actionable intelligence on revenue cycles and account receivables

Payor-wise and Ageing-wise trends

Trigger enabled alerts for continued rejections and above-threshold outstanding